The 13th edition of ReportCalcio has now been released

The President of the Federation, Gabriele Gravina, has presented the annual report on Italian and international football, developed by the FIGC Study Center in collaboration with AREL and PwC Italia, to Sky Studios: "Football has extraordinary potential [...] However, there is a need to restore balance to the system, controlling costs and allocating resources for investments in youth and infrastructure”Thursday, August 3, 2023

An increase of 210 thousand players of both genders in a single year sees a return to pre-pandemic levels; With an estimated over 4.5 billion Euros contribution to the national economy, the socio-economic impact of football is clear; The asset of youth nationals as evidenced by the recent results of the Under-19 and Under-20 squads, and the third highest commercial revenues that derive from national teams in Europe, according to the FIGC. But, there has also been a net loss of 1.4 billion euros to the professional football system and the need for structural investment in a new generation of football facilities in Italy is ever-more urgent.

These are just some of the facts, figures, and food for thought that has emerged from the 13th edition of ReportCalcio, the annual report on Italian and international football developed by the FIGC Study Center in collaboration with AREL (Research and Legislation Agency) and PwC Italia.

Published on the Federation website, the ReportCalcio was presented on Sky Sport 24 in the special hosted by Luca Marchetti. Featured on the show were FIGC President Gabriele Gravina, journalist Paolo Condò and Corriere dello Sport columnist and manager Alessandro Guidice.

With its 13 editions published since 2011, ReportCalcio embodies a successful path with the objective of enhancing transparency and creating a wealth of numbers, data points and trends of strategic value. Many topics are analysed, reflecting the multidimensional growth of Italian football: From the census of sporting activity to the profiles of the National Representatives (on a sporting, media and commercial level), from the study on women’s football, youth and amateur football to the analyses of the economic-financial, organisational, infrastructural and fiscal profile of the professional system, together with appropriate international comparison.

“This umpteenth study clearly shows the extraordinary potential of the world of football in its entirety…” explained FIGC President Gabriele Gravina, “which is the number one development factor in sport and one of the most socially relevant in our country. ReportCalcio represents a contribution of transparency, but above all, an incitement for all the stakeholders to understand the strengths and weaknesses of the movement, so as to study and put the shared solutions into practice. The FIGC’s objective is to facilitate a process of integral development that starts with the people in order to update the processes, improving the availability of football in every shape and form. And for this reason, among many, that the figure to highlight is the recovery of the more than 200,000 Youth and School Sector members lost during the pandemic. Regarding the economic aspect, however, the evidence points to a need to rebalance the system, getting costs under control and allocating resources for investment in academies and infrastructure.”

“Compared to the aggregate economic loss of EUR 1.3 billion registered in 2020/21, a season heavily impacted by the pandemic, an even higher loss of EUR 1.4 billion was lost in the 2021/22 season,” explained Federico Mussi, PwC Italia Partner. “This is the worst result in the 15 years analysed in the ReportCalcio, confirming the fact that the sector has structural problems. In the last three seasons, the total loss incurred by Italian professional football amounted to almost EUR 3.6 billion. The cost of wages continues to weigh heavily on the accounts, which in the last season was close to 84% of revenues (net of capital gains). From a financial point of view, the total debt of professional football in 2021-2022 exceeds the threshold of EUR 5.6 billion and the liquidity ratio, averaging 0.5 for both Serie A and Serie B clubs, significantly limits the possibility of making investments. Now more than ever, professional football needs better systems and models to monitor and control costs in order to correspond with cash generation. Compared to other European leagues, Italian football has worse financial-economic parameters, a greater dependency on television revenues, fewer measures to support youth football and fewer infrastructural investments. Nevertheless, the sector continues to attract capital and investors, often driven by a strategy of globalisation which aims to improve TV rights and broadcasting, brands and merchandising and investments in technology and digital areas. On the investment front, the bid to host the 2032 European Championships represents a great opportunity to accelerate infrastructural investments. These investments appear more and more indispensable to the growth of the Football System and more.”

Italian football: A strategic asset of the national economy

Considering the sporting aspect, FIGC members in 2021-2022 amount to almost 1.4 million (the Federcalcio would today represent the third largest "municipality" in Italy in terms of population): the football system has shown an extraordinary capacity to bounce back from the short-term impact of the pandemic; registered football players have essentially returned to the same levels as before Covid-19, growing by 24.9%, with an increase of almost 210,000 players in just one season (up from 840,054 in 2020-2021 to 1,049,060 in 2021-2022).

The most significant changes were recorded within the primary strategic asset of Italian football: the youth sector. 2021-2022 counts 807,807 Under-20 members, up by 36% compared to 2020-2021, with male footballers aged between 5 and 16 representing 20% of their age group in Italy (compared to 14.4% in 2020-2021).

Focus on women’s football

In the 2023 ReportCalcio, there was a focus on the growth of women’s football: Between 2008 and 2022, the number of women’s footballers registered with the FIGC almost doubled, going from 18,854 to 36,552 (with an increase of 10,000 in the last year and a growth of approximately 9000 compared to the pre-pandemic survey). In terms of fan bases, there are an estimated 10.2 million fans of women’s football in Italy; A growth of 2.2 times is predicted by 2033, with a fan base of 22.6 million.

During this period, the commercial value of women’s football could increase by 7.1 times, from EUR 6.6 million to 46.7 in 2033.

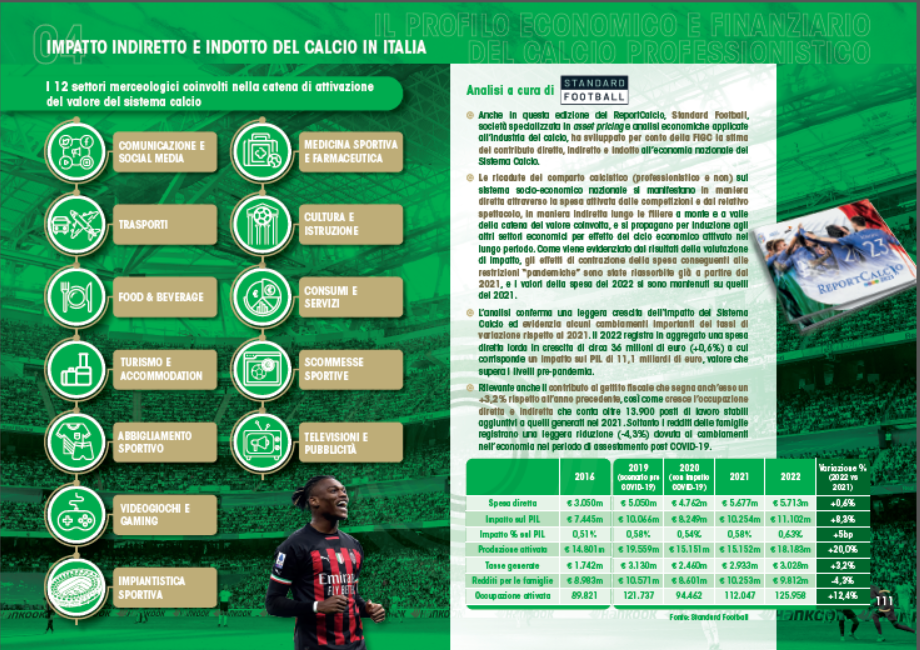

Moreover, between the 2020/21 and 2021/22 seasons, the number of official matches increased by 10 times, from 43,490 to 480,482, played at 13,249 different pitches in Italy. At the same time, the socioeconomic impact of football on the country is estimated at over EUR 4.5 billion, in the strategic sectors of health, economy and sociality. Football continues to be one of Italy’s principal passions: 57% of the population, or approximately 34 million people, would call themselves interested in the sport, whilst the 50 most viewed television broadcasts in Italy’s TV history are all football matches (47 of them, National Team matches). Football betting revenue in 2022 is €13.2 billion, a figure that has grown more than sixfold in just 17 years (in 2006 it did not exceed €2.1 billion). Considering international exposure, the cumulative worldwide TV audience of Italian football is estimated at 1.44 billion viewers, with a fan base exceeding half a billion people.

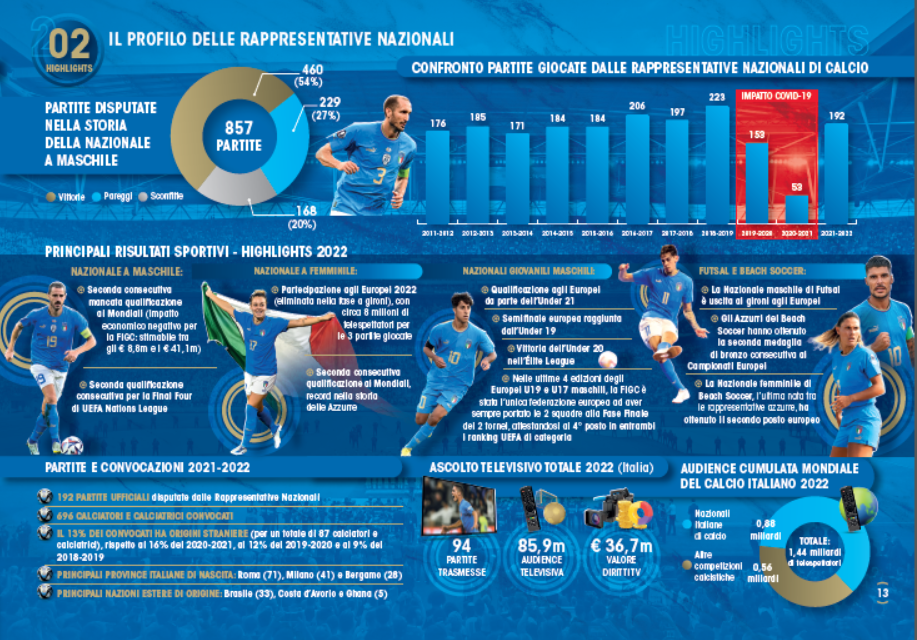

Footballing activity constitutes an ever more important industrial sector of our country; direct revenues amount to EUR 5 billion. Considering also the indirect and induced impact produced on the 12 product sectors involved in the value chain of football, the impact on Italian GDP can be estimated at over EUR 11.1 billion, with almost 126,000 jobs created. At the same time, the tax and social security contributions of top-level football (Serie A, B and C) in 2020 exceeded EUR 1.3 billion; the 99 professional football clubs make up 73.1% of the total sporting contribution in Italy (50,000 clubs and entities), a record high since 2015. In the last 15 years that have been analysed, for every euro ‘invested’ by the Italian government into football, the country has received €18.90 in terms of tax and social security. In this period, Italian professional football has generated over EUR 16.8 billion in tax and social security contributions, whilst the FIGC has received EUR 891.6 million from CONI / Sport and Health.

National football

In 2021-2022 national teams played 192 matches (with 696 players of all genders taking part), a significant increase compared to the last two seasons (53 games in 2020-2021 and 153 in 2019-2020), which were significantly impacted by Covid-19.

The latest data available confirms once again the appeal of the Azzuro shirt. Particularly important are the results at a commercial level following an internalisation process of commercial functions that were previously delegated to an external advisor, with a significant investment in Human Capital: between 2018 and 2022, the total number of employees in the Business/Revenue Area of the FIGC has grown from 7 to 27.

Despite failing to qualify twice consecutively for the World Cup and the impact of the pandemic on the sports sponsorship sector (which some estimate led to a 37% decrease in market value at the height of Covid-19), the four-year period of 2019-2022 represented a record time: FIGC revenue from sponsorships grew significantly compared to previous contract cycles, increasing from 161.5 million euros in 2015-2018 to 189.9 million in 2019-2022 (up by 17.5%, with an increase of 28.4 million, while the growth rises to +47.5% if the technical sponsor (a separate category) is excluded from the calculation. This means that the FIGC finds itself in third place amongst the 55 European football federations for commercial revenues deriving from their respective national teams.

Moving on to the analysis of sporting results, after the extraordinary performances in 2021, culminating in the triumph of Mancini's Azzurri at the Euros, 2022 was unfortunately marked by a second consecutive failure to qualify for the World Cup after suffering a defeat in the playoffs against North Macedonia. However, in the following months, the national team achieved their second consecutive qualification for the Final Four of the UEFA Nations League (reaching the final third place in 2023).

The Azzure, coached by Milena Bertolini, took part in Euro 2022, going out at the group stage but with record results in terms of audience: 2.7 million viewers on average per game, an almost 7-time increase compared to 2017.

The women’s national team then went on to qualify for the Women’s World Cup for the second time consecutively, a record result in the history of the FIGC. The men’s national Futsal team went out in the group stage of the European Championships and the men’s Beach Soccer National Team won a bronze medal at the European Championships for the second time on the trot. The women’s Beach Soccer National Team, the newest representatives of Italy at a national level, also achieved great results, placing second in Europe and the national e-football team reached the semi-final of the FIFAe Nations Cup 2022, the principal international e-sports competition.

The men's youth national teams continued the trend of positive growth, with the Under-21s qualifying for the European Championship (for the sixth time in a row), the Under-19s reaching the European semi-final, and the Under-20s winning the Elite League (the main category competition organised in Europe).

Between 2022 and 2023 Italy represents the only football federation in Europe to have had 4 youth squads qualify for the final stages of the 4 most important tournaments (the U20 World Cup and the U21, U19, and U17 Euro). That is as well as being the European nation with the highest number of appearances in the final stages of the European and World Championships in various categories (U21, U20, U19 and U17), with a total of 24 qualifications (ahead of France, England and Germany, at 22) between 2013 and 2023.

© Uefa.com

© Uefa.com

Extraordinary results, followed up on in 2023 with the Under-20 National team qualifying for the first time in history for the U20 World Cup held in Argentina; the defeat sealed in the last minutes of the final against Uruguay finally put a stop Nunziata’s men who had reached the final overpowering huge opponents Brazil, England, and Colombia.

Italy were also able to console themselves with the top scorer and best player achievements of Cesare Casadei, who scored 7 goals in 7 games, together with the best goalkeeper award obtained by Sebastiano Desplanches. The competition also produced extraordinary audience figures; counting around 800,000 viewers for the semifinal played against South Korea and almost 1.6 million for the final played against Uruguay, a historic record for an Italian youth national team below the Under-21 level.

Only a few weeks later, the men’s Under-19 squad, coached by Alberto Bollini, won the European title. This made it the second win in history for the young Azzuri who won the competition 20 years previous with a 1-0 victory over Portugal at the final in Malta, a game broadcast on Rai 3 and watched by over 1.5 million viewers.

RETURNING TO ITALIAN TALENT. The excellent results obtained by the Italian youth national teams, as described above, testify to the quality of the best Italian talents. This has made possible a significant enhancement of the supply chain to the youth national teams and the corresponding effects on the generational turnover of Roberto Mancini's squad are evident: the average age of the Azzurri has dropped from 29.5 years when qualifying for the 2018 World Cup to 26.5 years in 2022; Italy is the third youngest national team in the top 20 of FIFA Rankings (behind only the United States and England).

The data presented above demonstrates how much Italian youth football represents a greatly valuable asset, which unfortunately does not find a natural "outlet” in professional football. In particular, among the 31 top divisions in Europe, the Italian Serie A represents the tenth oldest league (26.36 years being the average player age), with the third highest number of foreign players (61.7%), and comes last for employment of players who came up through the youth sectors of their own clubs (just 8.4%). In the 2021-2022 Serie A season, the time played by Italian Under-21 players accounted for just 1.9% of the total, compared to 34.3% of Italian Over-21 players, 61.3% of foreign Over-21 players and 2.5% of foreign Under-21s. A scenario that details the growing dispersion of talent: among the 2,405 youth players (15-21 years old) registered for Serie A clubs in 2012-2013, just 102 (4.2%) are still operating in the top series of Italian professional football after 10 football seasons (in 2021-2022), while 90 play in Serie B (3.7%), 168 in Serie C (7.0%) and 1,149 in amateur football (47.8% ); another 250 players have ended up abroad (10.4%), and 646 (26.9%) are no longer playing.

The potential changes to orchestrate the greater use of young Italian talent appears to be very significant, ultimately also increasing their level of experience in the first team to close the gap with main competitors on the European scene; Italian Under-21 players employed in Serie A in 2021-2022 accumulated less than 60,000 minutes in the first team over their entire career, compared, for example, to over 200,000 minutes for Spanish and French talent (with significant gaps at first division league level and European Cups); in the top 15 of Under-21 players ranked by play time over their career in the first division there is only one Italian (and no Italian in the top 15 of the Champions League).

The finances of professional football

The pandemic caused significant socioeconomic repercussions, starting with professional football. The total loss of the Serie A, B and C leagues during the three-year period of COVID-19 (2019/20, 2020/21 and 2021/22) was approximately EUR 3.6 billion (€3.3 million a day on average); an average loss of 1.2 billion per season, compared to the 412 million Euro loss in 2018/19. During the pandemic, 82.6% of clubs reported losses (218 out of 264 analysed). On an aggregate level, in the 15 years analysed by ReportCalcio (2007/08-2021/22), the total loss in Italian professional football was EUR 7.7 billion; the 1.4 billion loss registered in 2021/22 was the worst in this 15 year period. Considering the financial situation, the total debt grew from EUR 4.8 billion pre-COVID-19 (2018/19) to 5.6 in the 2021/22 season (17.2% increase). In the first season analysed in the ReportCalcio (2007/08), the figure stood at EUR 2.4 billion. Shareholders' equity at the aggregate level stood at EUR 440 million, down 35.9% from 2020-2021.

A significant factor in the worsening economic situation came from the negative effects of COVID-19, which had an above-average impact on football and sport in general. in particular, the average annual value of production in the three-year COVID-19 period was EUR 3.5 billion, a decrease of 11.2% compared to 2018/19, the last pre-COVID-19 season; the 2021/22 season saw a EUR 3.4 billion value, 12% less than 2018/19, while in comparison between 2019 and 2022 Italian GDP grew by 1%. Considering the impact of the closure of stadiums (matches behind closed doors or with a limited capacity), ticketing revenue decreased from EUR 341 million pre-COVID to 266 in 2019/20 and then 28 in 2020/21. Revenues increased once more in 2021/22 with 254 million; in the three-year COVID-19 period, it is estimated that over 29 million potential match-goers were lost due to restrictions, with approximately EUR 632 million of potential ticketing revenue not realised. In the 2021/22 season, alongside the gradual reopening of stadiums (100% capacity reintroduced in April 2022), the influx of fans climbed to 11.9 million, compared to 0.15 million in 2020/21. This figure is still way off from the pre-COVID-19 numbers (more than 16 million).

In addition to the impact of COVID-19, a significant component of the worsening financial results is connected to the clubs' inability to contain, even at the peak of the pandemic, the growth of salaries and depreciation/amortisation (i.e. mainly the impacts in the income statement in the transfer market); average revenues for clubs pre and post-pandemic decreased by 11.2%, whilst at the same time, the average labour cost grew 9.6% and amortisations/depreciations 19.5%. The share of labour costs on the value of production increased from 53% in 2018-2019 to 70% in 2021-2022, while the share of labour on sales revenue (value of production net of capital gains) increased from 69% to 84%.

A hugely difficult situation, regarding a sector which in other methods of analysis is showing very positive trends: From the record attendance at stadiums to the impressive performances of our clubs on the international stage, reaching the finals of 3 European Cups. 3 Italian teams in the UEFA Champions League quarter-finals and 2 in the semi-finals of both the Champions and Europa League. Despite the defeats in the 3 finals, Italy received its highest-ever total in the seasonal UEFA Ranking with 22.357 points (second best in Europe, behind only England with 23.000). Italian football’s capability to attract investments and foreign capital must be noted, with 19 companies from abroad in professional Italian football (about one club in five owned by foreign investors), 11 of which are from the United States. These resources from foreign owners have been vital in supporting Italian football in these last few years of difficulty: On an aggregate level, between 2011 and 2022 over EUR 6.2 billion has been recapitalised, of which 37% has come from Italian owners and 63% (€3.9 billion) from clubs with foreign owners (mainly from the United States and China).

Sporting infrastructure

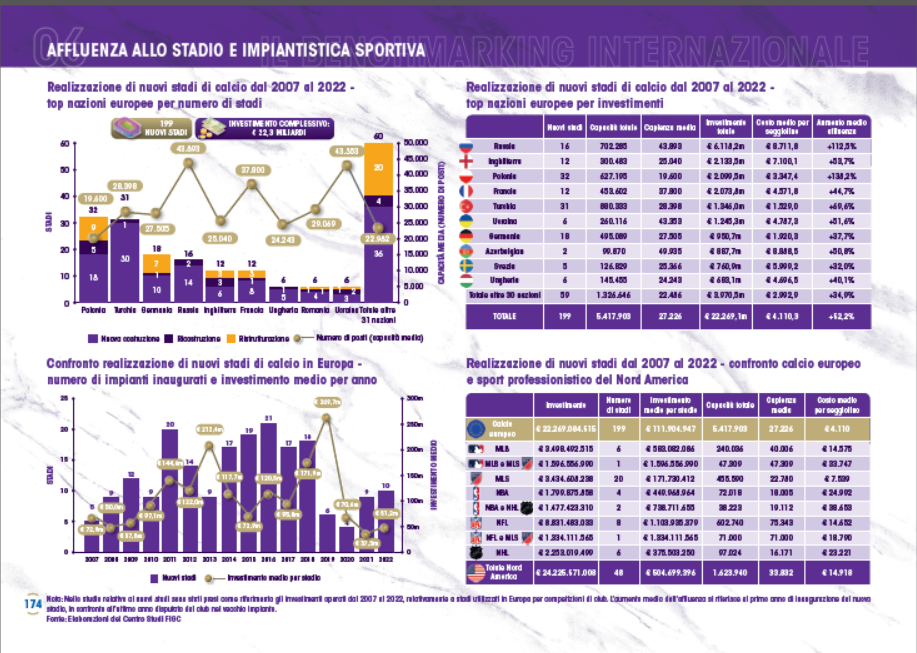

The launch of an investment programme for a new generation of footballing facilities in Italy seems ever more unavoidable, in order to reduce the growing gap between other footballing countries: In the last 16 years in Europe (2007-2022), there have been a total of 199 new stadiums built, with an investment of EUR 22.3 billion: Mainly responsible for this are Poland and Turkey (more than 30 new stadiums), ahead of Germany (18) and Russia (16). Italy, with 5 new stadiums built in this period (Juventus, Udinese, Frosinone, Albinoleffe and Südtirol) has realised only a fraction of this potential, accounting for just 1% of the total investments made in Europe.

The figures demonstrate the need to start a major renovation process of the sports facilities as soon as possible. The average age of stadiums in the Serie A is 61, 65 in Serie C and 67 in Serie B. Only 12% of stadiums in the top division make use of renewable sources of energy, and just 7% of the facilities in Italian professional football are not publicly owned. These figures lay testimony to the immediate urgency for new investment, also considering the important impact that will be brought upon by a new generation of sporting facilities in Italy. With reference to the 14 projects for new football stadiums currently in the planning and/or actual construction phase in Italy, for example, a total investment of EUR 2.9 billion is estimated. This will generate a positive impact in terms of a potential increase in stadium attendance (+3.3 million) and ticketing revenues (+EUR 205.8 million), as well as in terms of employment (with the creation of almost 12,000 new jobs).

International benchmarking

Extending the analysis to the international scene, European football continues to be the most relevant stage, but at the same time a sector heavily impacted by the health emergency, significantly more than the average of the other economic sectors. With reference to economic figures from the 700 clubs participating in the 55 top divisions, in the two-year 2020-2021 period, EUR 4.2 billion less revenue was generated than in 2019, principally due to the cease in ticketing (3.3 billion in 2019 to 0.5 in 2021), whilst costs increased during the health crisis (thanks in particular to the increase in wages, from 14.7 billion in 2019 to 15.9 billion in 2021). As a result of these dynamics, during 2020 and 2021, an aggregate loss of EUR 7.7 billion was incurred, as opposed to EUR 0.5 billion ‘in the red’ in 2019 and a profit of EUR 0.6 billion in the two-year 2017-2018 period. On a financial level, the net worth between 2019 and 2021 dropped by 20.2% (10.3 to 8.2 billion) and total debt grew by 11.1%, from EUR 29.5 to 32.8 billion.

Despite this structural imbalance and the impact of COVID-19, in the last few years, we have seen further confirmation of the fact that European clubs very much have the ability to attract capital and investment: In the three-year period of 2020-2022, 90 European football clubs changed owner in a growing trend: 25 in 2020, 30 in 2021 and 35 in 2022; in 39 of those cases (43%) the new owners have been from different countries, particularly from the United States (18 purchases). Moreover, in the last few years, several private financial operators have begun to invest in footballing organisations, a trend which was accelerated during the pandemic; in 2022 alone, of the 39 main-share-acquisitions (majority or minority) of footballing organisations in Europe, 30 were by investment funds/ private equity, with a total investment estimated at around EUR 14.5 billion. Another thing of note, the growth of multi-ownership and multi-club investments. The number of football clubs on a global level that are part of a multi-club network has grown from 40 in 2012 to approximately 100 in 2019 and 180 in 2022.

ReportCalcio 2023 also carries out analyses in relation to the 181 clubs that are part of the top 10 European divisions (England, Germany, Spain, Italy, France, the Netherlands, Portugal, Turkey, Russia, and Scotland). Digitally, the number of fans and followers on the major social networks (Facebook, Twitter, Instagram and TikTok) reached 2.6 billion in 2022, with 19.9 billion views on YouTube. From a commercial point of view, there are 3,886 sponsorship agreements, of which 26% are from abroad, while the most represented product sectors are those relating to Services & Consulting (442 sponsorships), Clothing & Fashion (360) and Beverages (325). There are also 228 shirt sponsorships (the main product sector remains that relating to betting, at 17%) and 62 stadium naming rights (of which 24% are endorsed by companies from the "Banking, Insurance & Financial Services" sector). In terms of other major trends observed in the most recent period, 143 clubs have an e-sports division in 2022 (compared to 67 in 2017); 41 companies have launched their own OTT channel; 22 companies have or helped create a docuseries on their business; 17 clubs are developing projects using the Metaverse, and 13 have opened an Innovation Center, while 12 companies have inaugurated their own Masters or Course in Sport Management, 30 have launched a Fan Token, and 45 have started NFT projects and collaborations.